New Businesses and Financing

New businesses, especially in research- and knowledge-intensive sectors, challenge established companies with innovative products, processes and business models. The establishment of new companies and the exit of unsuccessful (or no longer successful) companies from the market is an expression of innovation competition for the best solutions and therefore an important aspect of structural change. Especially in new fields of technology, in the emergence of new demand trends and in the early phase of transferring scientific findings to the development of new products and processes, young companies can open up new markets and help innovative ideas achieve a breakthrough.

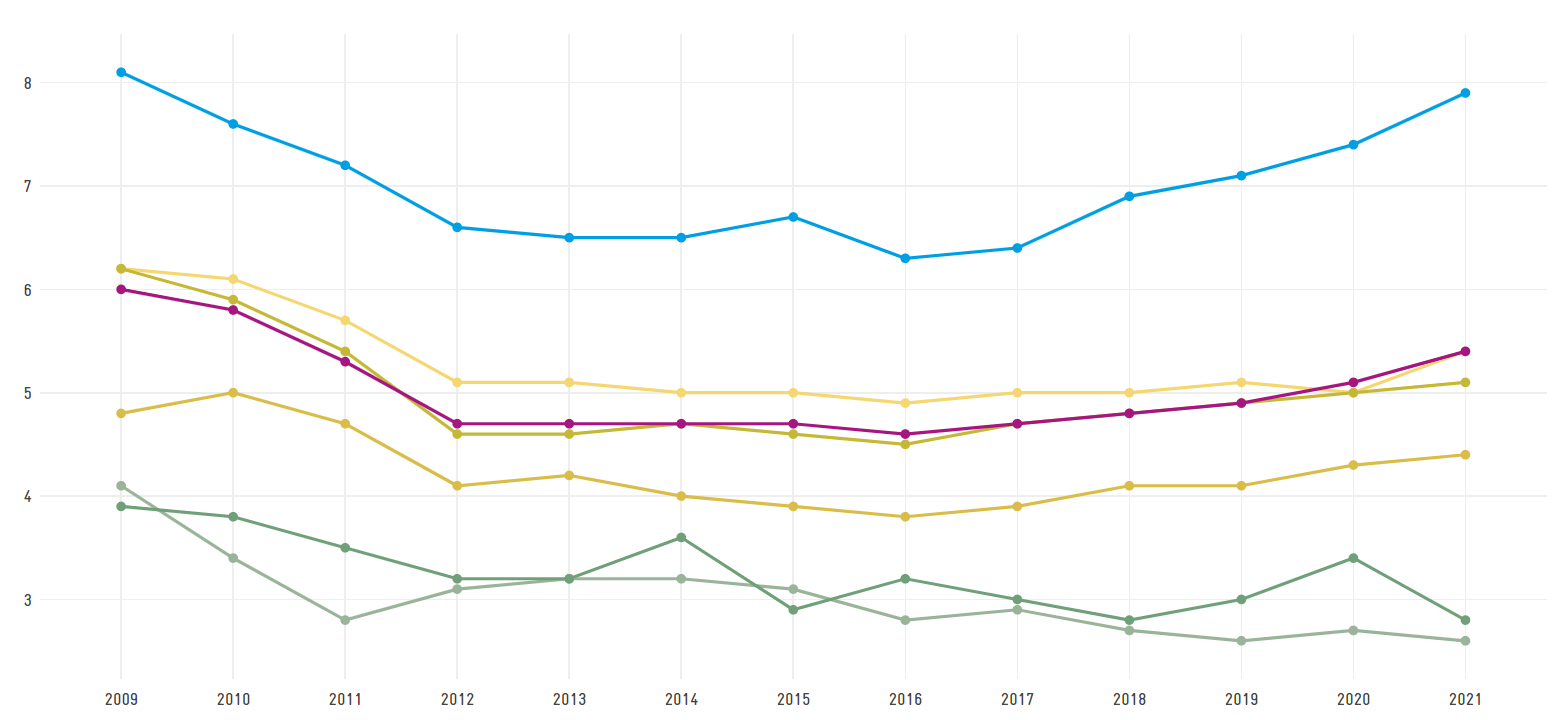

Financing business and especially R&D activities is a major challenge, especially for young, innovative companies. As these companies initially generate little or no turnover, financing out of their own resources is hardly possible. Debt financing is difficult because it is hard for investors such as banks to assess the prospects of success for innovative start-ups. Alternative ways of company funding include raising equity capital or venture capital as well as financing through government funding. The interactive charts illustrate start-up activity and the availability of venture capital in the early1 and later2 stages of the start-up process in Germany and in an international comparison.

1 The early stage comprises the company’s seed and start-up phases.

2 The later stage comprises the company’s growth and maturity phases.